Every year producers of wheat flour hope to get active and unimpeded experience of work on the market. However, annually the enterprises face various obstacles on the way to the prosperous work. It should be noted that during almost the entire first half of 2012/13 MY the situation on the export market of flour was relatively stable and measured, but in late 2012 the situation changed and presented the unpleasant surprise for flour millers. At the same time, since the second half of MY the current market trends changed again, indicating that Ukrainian exporters of wheat flour can “cross” through the existing problems of the market and continue moving forward. Thus, you can read in the current article about how the situation developed in the reporting season, and what difficulties had to be overcome on the way to successful work of grain processors.

Despite the low selling rates of finished products last MY, many producers of wheat flour did not lose hope for improvements in the new season. Since beginning of 2012/13 MY, flour producers continued developing export trading of their commodities. The persistence of exporters led to increased rates of shipments of flour milling products. According to the market players, in the current season export volumes of the finished products can significantly overcome the result of 2011/12 MY. According to data of the State Statistics Service of Ukraine, during the whole period of last MY Ukraine exported 115.2 thsd tonnes of flour. At the same time, in the current MY from July 2012 to January 2013 the shipments totaled 116.2 thsd tonnes. Taking into account that there is enough time until the end of the current MY, flour milling enterprises are quite capable to increase the volume of flour exports.

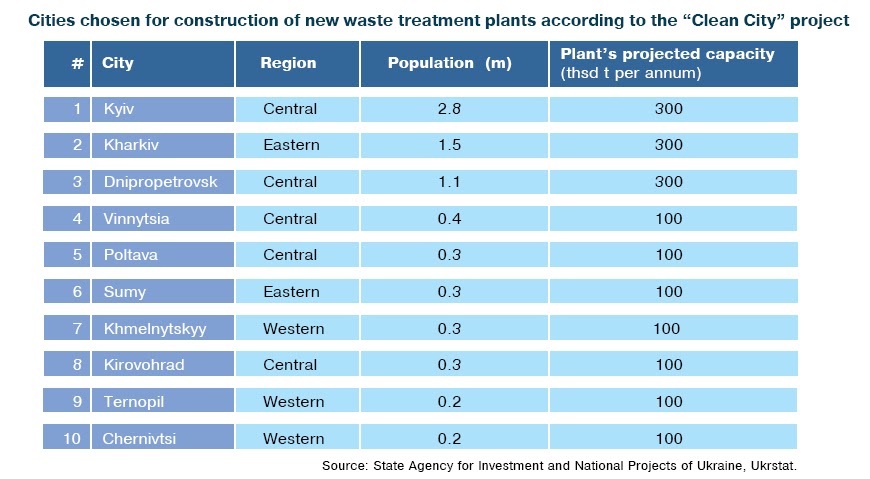

As for the main directions of flour supplies, we should note that in the current season the companies significantly increased the export volumes to the CIS countries. According to the State Statistics Service of Ukraine, in the period from July 2012 to January 2013 the supplies of flour finished products to the CIS countries grew to 62.9 thsd tonnes, an increase of 25% compared with last MY, when Ukraine shipped 46.9 thsd tonnes only. Also, in the reporting period wheat flour producers increased shipment volumes to the Middle East to 9.5 thsd tonnes, up 30% compared with the shipments in 2011/12 MY. Thus, Moldova (26.7%), Indonesia (25.3%) and Azerbaijan (17.7%) were the main three leaders of the countries-importers in the season. However, due to very rapid rates of flour shipments to Azerbaijan in recent years, the country can take the second position in the list of the main countries-consumers of Ukrainian wheat flour in the nearest future.

Naturally, we can not ignore the major companies-suppliers of flour for exports. According to the State Statistics Service of Ukraine, the bakeries LLC “Kombinat Khliboproduktiv TALNE”, “Lugansk-Niva Ukraine”, Vinnytsia Center of Grain Production #2 became the leaders among grain processing enterprises in terms of foreign shipments in 2012/13 MY. It is worth reminding that in 2011/12 MY, Vinnytsia Center of Grain Production #2, LLC “Kombinat Khliboproduktiv TALNE” and Company “Enlil” were the leaders of flour shipments.

Limitations – not an obstacle for the strong

According to the market operators, since the beginning of the current season flour millers were not expecting for new challenges. Thus, almost the entire first half of the current MY showed conventional, probably characteristic difficulties for the flour market. Traditionally, problems with getting rail cars for flour shipment by the milling enterprises and difficulties to ensure sufficient grain volumes for processing for the enterprises, prevented the stable operation on the market. However, many flour millers tried to cope with these difficulties, continuing to supply products on foreign markets as usual.

The official report on imposition of the special duty on wheat flour at 20% of the customs value by Indonesia since the beginning of December 2012, became rather unpleasant and unexpected news for exporters of flour at the end of the first half of 2012/13 MY. According to the market participants, the duties cover both imports of flour of food and feed purposes. According to grain processors, imposition of the reporting limitations on the imports of grain by-products to Indonesia was caused by the fact that the country intends to increase production of own flour volumes.

In the new circumstances, a number of traders, supplying the finished products to the country, reported that they plan to increase the share of flour presence on the domestic market, and look out for a way to deliver the finished products to other countries. Also, grain processors reported about their plans to increase flour shipments to the main countries-importers of Ukrainian products. In particular, countries of Asia, the Middle East and the CIS were called as potential buyers of flour from Ukraine.

Optimistic continuation

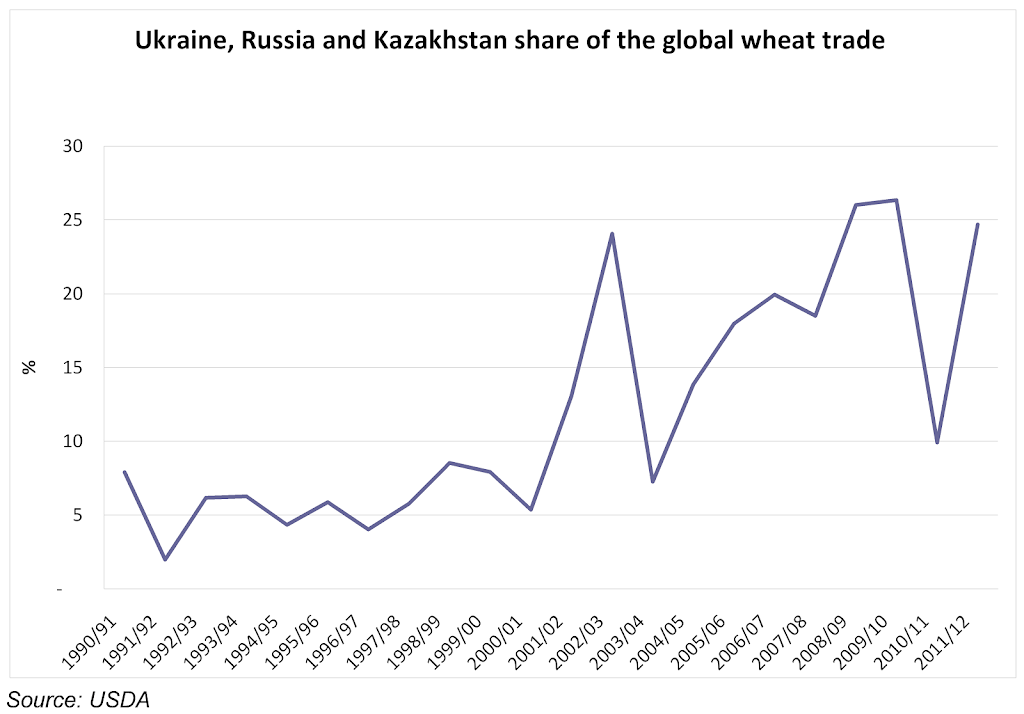

Since the beginning of 2013 the situation on the export market of flour did not worsened, despite the fact that Ukraine lost the main importer of its products – Indonesia. On the contrary, due to the increase of prices for grains and by-products on the world market, Ukraine received additional opportunities to press its major competitors – Russia and Kazakhstan – on the export market.

It should be noted that since the beginning of January 2013, Turkish companies reduced activity on the export market of flour. Previously flour producers in Turkey purchased grains from Russia and Ukraine, which are currently not active on the exports of milling wheat, and significantly reduced their grain processing operations. Despite the fact, some plants reported that Turkish flour exporters still remain the main competitors for the shipment of finished goods to African countries.

However, the plans of market participants to increase the supply of flour on the domestic market failed, due to the fact that since the beginning of 2013 the Agrarian Fund entered the market, which used its reserves and activated flour supplies to bakeries. According to the market operators, the stocks of flour products reduced the consumer demand for commercial flour on the domestic market. And grain processors had no choice but increasing the exports of flour.

Price situation

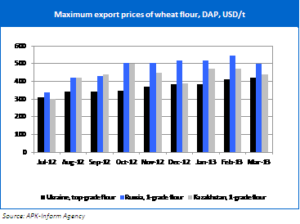

It is worth noting that in the second half of the season, the export price for the finished product became the top-priority of Ukrainian companies. As of early March 2013, flour milling complexes declared the selling prices for top-grade flour at the level of 360-415 USD/t from the enterprise, down 40-100 USD/t compared with the main countries-competitors.

Despite the fact that the offer prices for Ukrainian flour also increased compared with the beginning of the current MY, most companies are looking to the future with optimism. However, most Ukrainian companies are not afraid of the current lowering of flour prices on the domestic market of Russia. A number of companies plan to significantly increase the selling prices of flour, due to expensive raw materials, assuming that even with such increase of prices, the demand for the final products of Ukrainian origin will remain quite satisfactory.

Conclusions

Taking into account the above mentioned factors, we can safely say that most of the season was not bad for the exporters of flour in Ukraine. Despite all difficulties and obstacles, the companies managed to keep the main selling markets for their products. However, in recent years more and more experts are saying that operators of the Ukrainian flour market need to expand into new markets for wheat flour. In the current MY flour producers showed quite good results, while expanding the geography of supplies. However, the final sum up will be possible at the end of 2012/13 MY only.